On March 23, U.S. stock markets closed the day after a multi-week plunge of nearly 30%. This drop coincided with a wave of lockdowns across the country, as well as similar moves throughout Europe, Latin America and South Asia. Since then, the U.S. economy has been in free-fall, with more than 26 million people filing for unemployment, waves of retail stores on the edge of bankruptcy, energy and oil companies teetering on the brink, travel grounded, and the GDP was down 4.8% in the first quarter and this quarter is likely to be much worse. The stock market? Overall, stocks are up across all indices more than 30% from that low point in late March.

What is going on? How can it be that stocks are soaring when the economy is crashing? Market movements are often head-scratching, but in this case, the answer may be relatively simple: because of moves by the Federal Reserve, financial markets are awash in money, vast, water-hose supplies of money. Since March, the Fed has committed to lend or buy trillions of dollars of financial assets, which by some estimates might end up exceeding $8 trillion dollars by the time all is said and done. No one knows how high that figure will climb. By way of comparison, during the last financial crisis in 2008-2009, the Fed ended up adding about $3 trillion over the course of several years.

And it’s not just the Fed. Congress has allocated almost $3 trillion in economic aid; the Bank of Japan is doing much the same as the Fed for the world’s third largest economy; the European Central Bank is not far behind, and multiple governments around the world are following suit.

The result is that even as real-world economies freeze and implode in the short-term, financial markets are buoyed by a tsunami of liquidity.

That troubles many investors, who see either sharp spikes of inflation or dire reckoning ahead for stocks and bonds. Respected investor Jeffery Gundlach, one of the most influential bond managers, warned this week that markets will soon head south fast and the people should be more “wary of panaceas.” Analysts at Bank America posit that the recent market strength is simply a dead-cat bounce like what happened in 2008 before a more intense crash later that year. Others believe that all the liquidity in the world cannot compensate for the collapse of real-world economic activity and these moves by the Fed and governments are the equivalent of flooding a drought stricken area with water for a few days. It feels like a relief, but if there is no rain in the months after, it does little good.

And yet, there is something else going on that should give pause to the belief that market strength is a head fake. If it were only about a sea of money floating everything, then you would think that stocks across the board would be going up. That is not the case.

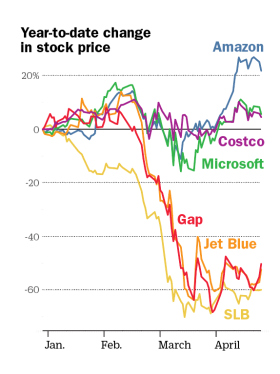

In fact, there is a dramatic difference in how individual companies are faring that reflects a cold-eyed assessments of how they will do in a pandemic world. Companies that are seen as especially vulnerable, such as retail stores spread across malls, are seeing stock declines of 50% and have only recovered marginally since March 23. The Gap, Macy’s, Michael Kors, all face daunting prospects, and no amount of liquidity in financial markets will paper that over. Energy companies, with plunging demand for oil and high debt loads, are in some cases on the verge of bankruptcy, and even the survivors like oil service giant Schlumberger (based in Houston) has seen its stock more than halved since March. The same is true for airlines and hotels. Yes, JetBlue’s planes will eventually fly and have passengers, but there is no guarantee that they will be operated by a company called JetBlue two years from now.

On the flip side, clear beneficiaries of the current upheaval are doing well. Five mega-tech companies – Amazon, Apple, Microsoft, Facebook and Google – alone make up $5 trillion of market cap, and Amazon in particular has seen its stock go up more than 30% since mid-March. Costco and Clorox have seen booming business along with Walmart, as has the video conference company Zoom.

So while markets are not moving on real-time economic fundamentals, they are moving on reasonable judgements of fundamentals going forward and distinguishing between industries that look to be hardest hits from those that might even benefit from the dramatic economic dislocations that COVID-19 responses are creating. If everything were going up indiscriminately, that would indicate markets were fully detached. There are not.

And for those who – understandably – might see all of this as yet further proof that once again, the financial world will get saved at the expense of tens of millions of real people and millions of small companies will get sacrificed, this time it is different. The Fed, for instance, is committed to purchasing hundreds of billions of dollars of municipal bonds at favorable rates, which will mean that cash-strapped state governments should be able to retain teachers and policemen and programs even if Congress proves negligent as Mitch McConnell seems to be pushing for. That will mean that pensions for public servants remain intact. The Fed also is about to lend another $500 billion to Main Street businesses, which is coming too late to avoid the pain of the last month but will still matter greatly to the ability of companies to move forward and eventually rehire. The most visible effect of the money in motion now is the stock market, but that will be not the sole beneficiary as more Fed money flows to states and Main Street.

So while it appears crazy that markets are doing relatively well as the world economy burns down, there is a method to the madness that reflects some potentially positive realities of an otherwise dire time. That may be small comfort just now, but it is a clear reminder that as bad as things are just now, they actually could be considerably worse.